Iron Butterfly Signatures in the BTC Options Market Ahead of Friday’s Expiry

The gamma positioning for the Friday, 12 December expiry reveals a distinctive and deliberate structure in the BTC options market—one that resembles a limited-volatility strategy, much like a Long Iron Butterfly.

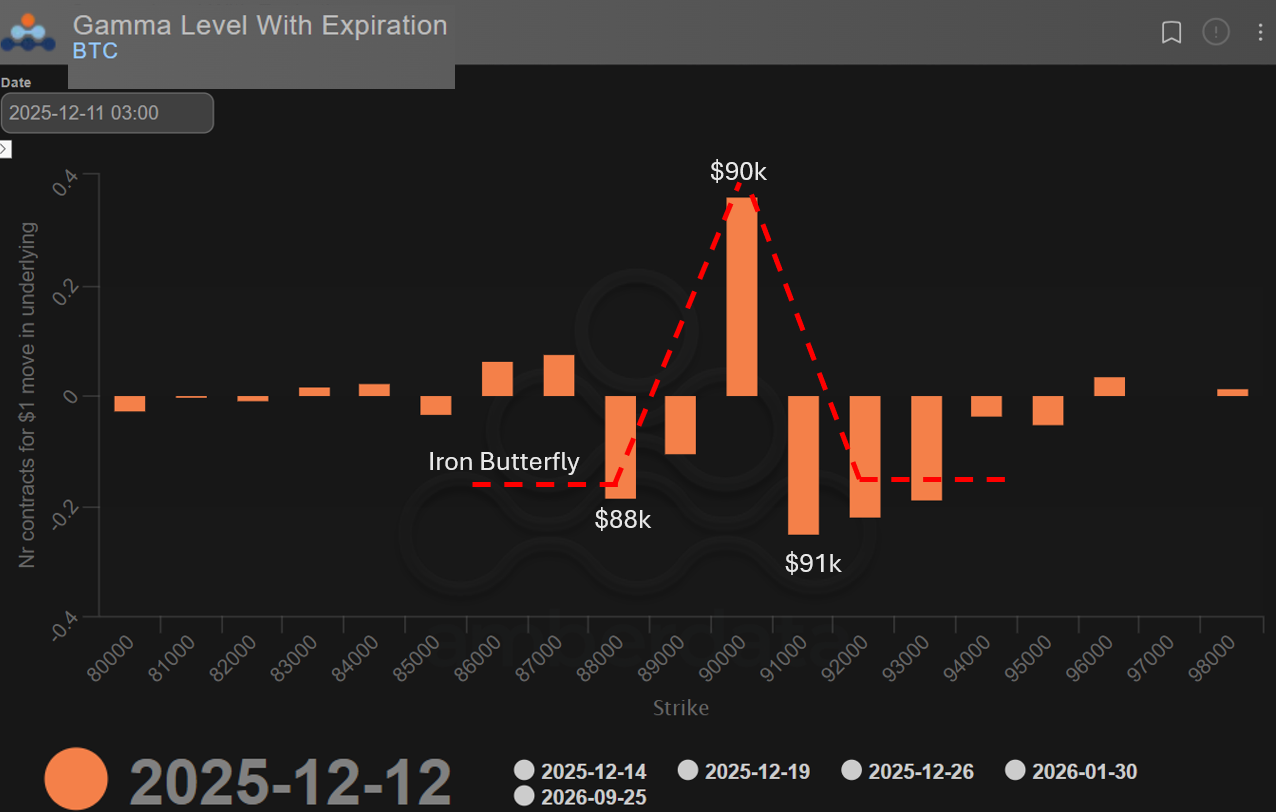

The chart above displays the normalized gamma exposure of Bitcoin options market makers (dealers), filtered for the Friday, 12 December expiry. It is expressed in units of underlying BTC that must be bought or sold per $1 move in order to remain delta-hedged. Although these values are net and cumulative across all taker flows, the pattern is unusually clear.

At the center of the formation sits the 90k strike, where dealers are long gamma. This implies that takers—who always hold the opposite side of dealer exposure—have been net sellers of options at 90k, pushing dealers into a position that stabilizes price around this level. In contrast, the surrounding strikes—88k, 89k, 91k, 92k, and 93k—all exhibit negative gamma, meaning dealers are short gamma (and takers hold the opposite exposure). The resulting shape strongly resembles the wings of an iron-butterfly-like structure.

Such symmetry is rarely accidental. It reflects a deliberate attempt by sophisticated traders to sell expected volatility rather than buy it. And the timing is notable: just a day before this snapshot, the Federal Reserve held its December 10 meeting to decide on potential rate cuts—a classic volatility catalyst.

Markets were primed for movement. Retail traders and directional speculators often respond to such macro events by buying volatility. Yet what we see here is the opposite:

the largest players in the BTC options market stepped in to sell that expected volatility and pocket the premium.

This is precisely the kind of positioning that distinguishes professional flows from speculative ones.

Gamma and its implications

- At 91k, where dealers are short gamma by roughly 0.25 BTC per $1, any approach toward this level can amplify price swings as hedging flows chase the market.

- At 88k, the short-gamma sensitivity of about –0.19 BTC per $1 creates a similar zone of potential acceleration.

- Meanwhile, 90k acts as a stabilizing anchor: with long gamma there, dealers hedge by selling strength and buying weakness, pulling price back toward the center.

The resulting tactical landscape for Friday’s expiry

- 90k is the gravitational pinning level, supported by long-gamma dealer flows.

- 88k and 91k are volatility expansion zones, where short-gamma exposure can fuel sharper, more aggressive moves.

- And overlaying the entire structure is a simple fact:

institutional players used the Fed-induced volatility expectations not to buy protection, but to sell it.

A moment where the BTC options market speaks with unusual clarity—and shows exactly who is in control.

Disclaimer

This analysis is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. Options trading involves significant risk and may not be suitable for all investors. Market views expressed here reflect current data and interpretations and may change without notice. Always conduct your own research and consult with a qualified financial professional before making trading decisions.