Introduction

With one of the year’s largest expiries behind us—over $12.3B in notional value and 104,000 contracts closed on July 25—the Bitcoin options market is now in a delicate phase of rebalancing. The expiry settled remarkably close to max pain, leaving many directional traders empty-handed and rewarding premium sellers. But beneath that quiet expiry, fresh positioning emerged almost immediately. From the structure of next week’s open interest to evolving volatility patterns and new strategic trades in the market screener, the post-expiry landscape offers valuable clues. In this Outlook, we dissect what traders did in the hours after expiry, what they expect for early August, and how a handful of large trades are shaping the market’s directional bias.

Explore these market dynamics firsthand with the Thales Options Strategy Simulator (OSS)

Market Snapshot

25 July Expiry Recap

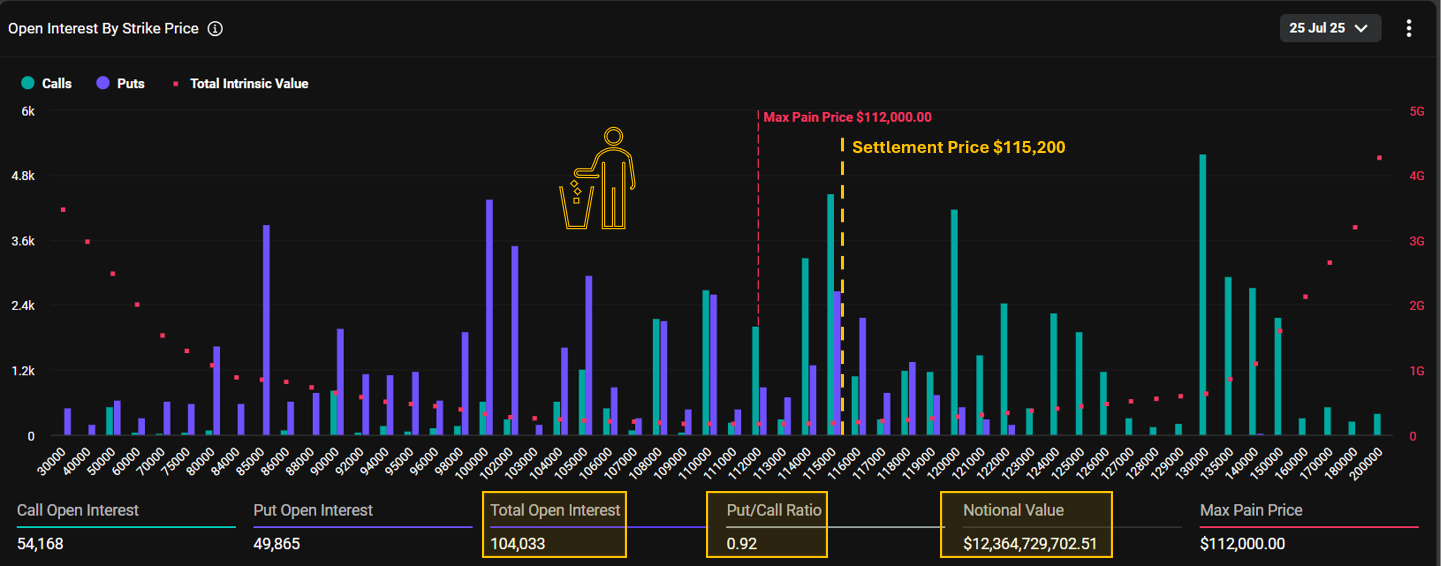

Settlement at $115,200 landed near the Max Pain point of $112,000, wiping out most OTM positions. Call sellers, especially at $120K–$130K, were the clear winners.

One of the most significant expiries of the year closed last Friday, with over $12.3B in notional value and more than 104,000 contracts in open interest.

(Deribit)

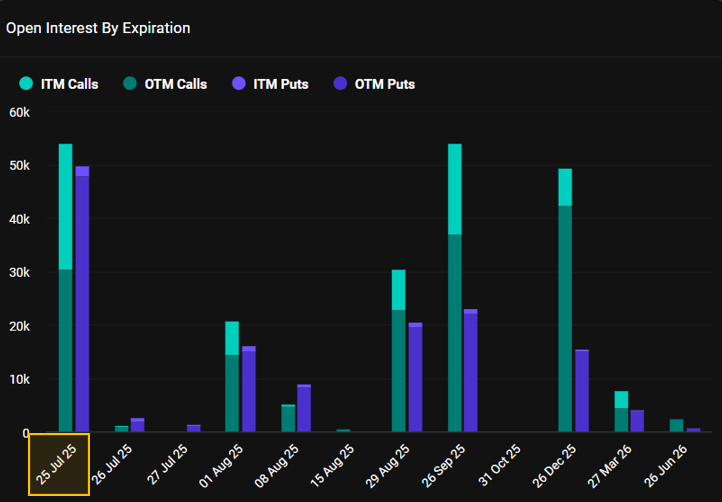

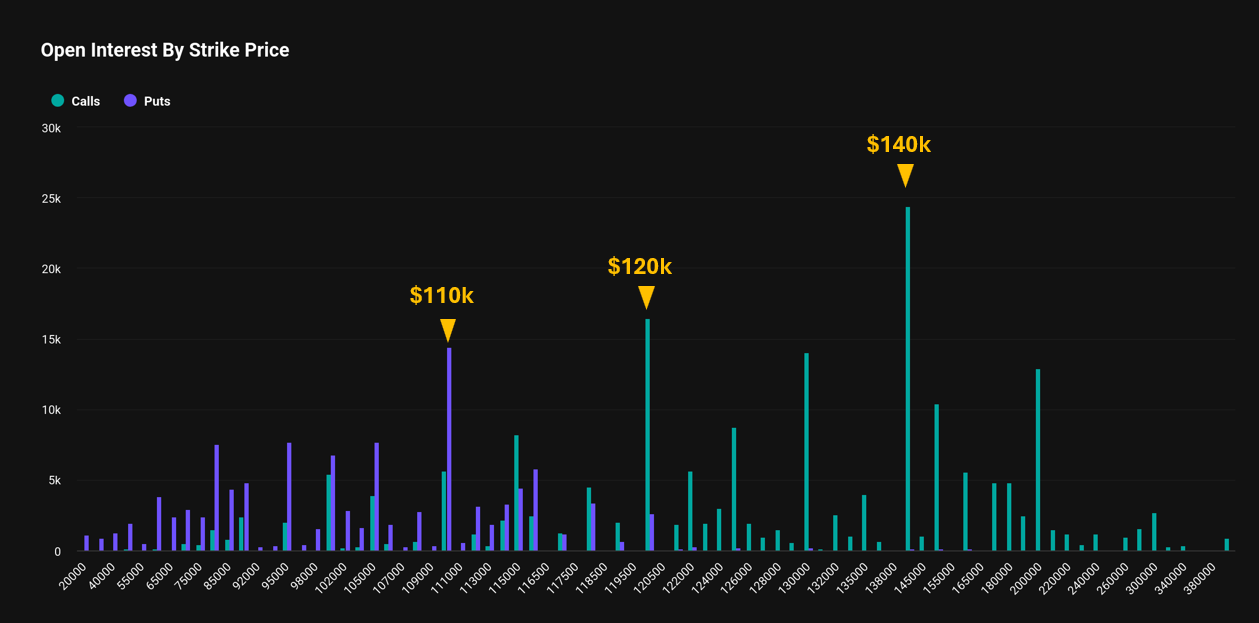

The 25 July expiry dominated with the largest concentration of open interest. Significant OI also builds around 29 Aug, 26 Sep, and year-end, showing traders positioning around key macro timeframes.

The settlement at $115,200 landed remarkably close to the Max Pain point of $112,000—rendering a massive portion of the open options worthless at expiry. Out-of-the-money call buyers at $120K and $130K, and put holders below $115K, saw their premiums evaporate. The clear winners were option sellers, who captured the bulk of premiums as the market pinned near max pain. That said, a few straddle buyers and those holding calls at $108K–$110K or puts that landed just in-the-money also saw some payoff. Despite Bitcoin trading above $120K just days prior, the expiry ultimately crowned premium collectors.

Next Friday

(Deribit)

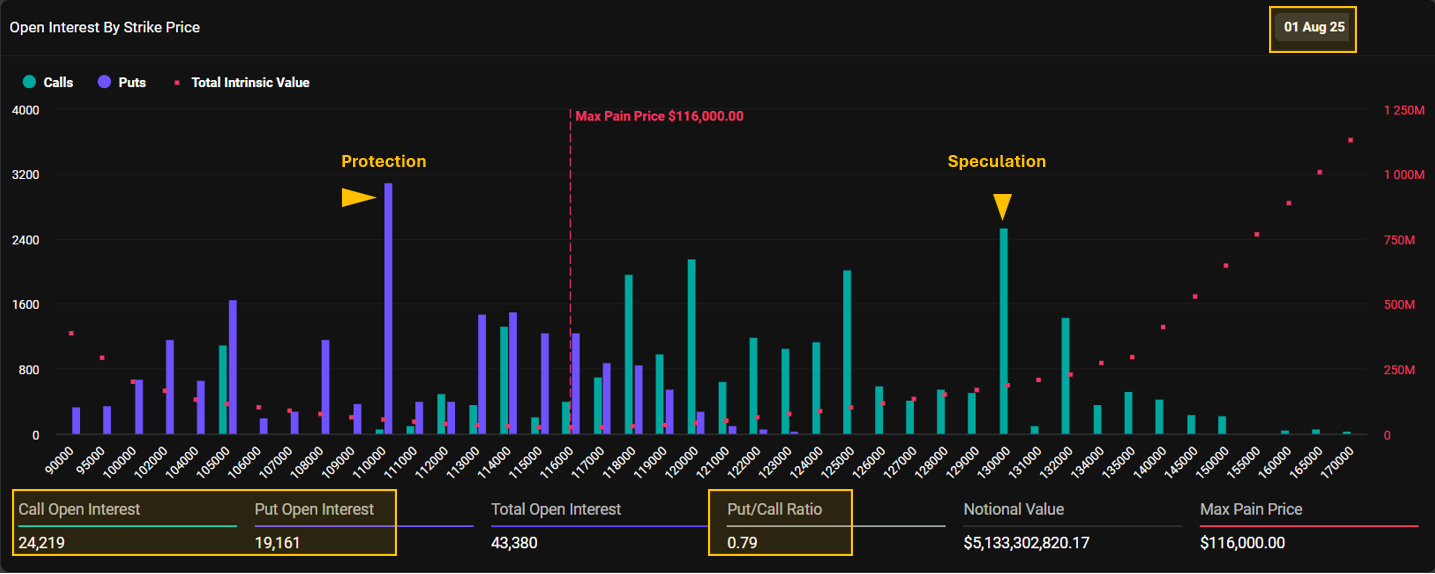

Open interest reveals defensive positioning at the 110K put and speculative appetite at the 130K call. The put/call ratio of 0.79 confirms a mildly bullish tilt, with the max pain level sitting at $116K.

Next Friday’s expiry (01 Aug) shows moderate bullishness, reflected in a put/call ratio of 0.79. Open interest remains healthy, with over 24,000 call options and 19,000 puts in play. Among the strikes, two levels attract notable attention: the 110K put, likely a protective hedge, and the 130K call, a clear speculative bet on a sharp upside move. With a notional value surpassing $5.1B, this expiry could be a key test of sentiment after the July expiry settled near max pain.

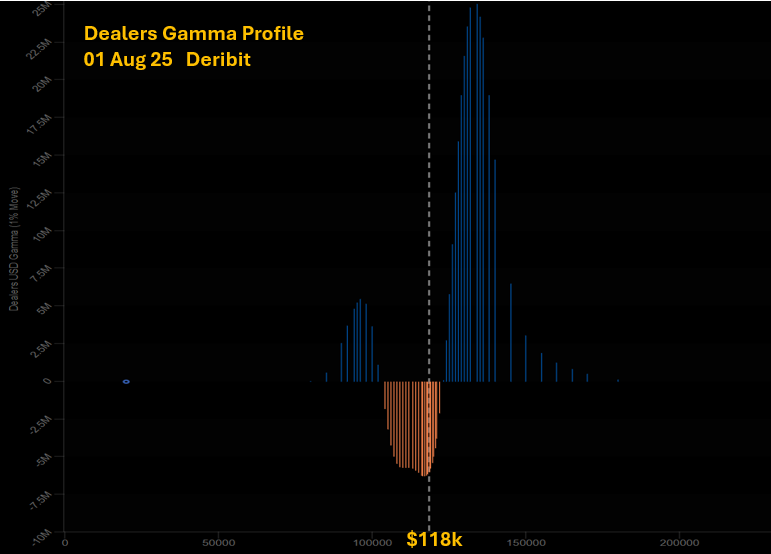

The gamma profile for next week shows dealers holding slightly negative gamma around the $118K level, turning strongly positive above. This setup suggests that options traders have been actively selling out-of-the-money calls, especially at higher strikes, rather than accumulating ATM options. Such a profile suggests the upper hand of sellers in the current market.

Rising Price, Falling Fear

The chart speaks volumes: Bitcoin’s implied volatility dynamics have undergone a structural shift in 2025. As noted in previous Outlooks, since BTC reclaimed the $100K level in May, implied volatility has steadily declined—both in magnitude and variability. Even the push to new all-time highs failed to lift IV meaningfully above 40%. More notably, IV has recently developed a negative correlation with price, reflecting a market that appears to view upward movement as baseline expectation, only reacting with volatility spikes on downside breaks or unexpected drops. This complacency toward bullish price action is a defining trait of the current regim.

Market Framing

To get a broader perspective, we examine the open interest across all expiries on Deribit. The data reveals a market structure that combines speculative optimism with calculated caution. A notable cluster of OTM call positions spans from 130k up to 200k and beyond, underscoring traders’ expectations for a continued bull run. At the same time, a distinct channel has emerged between the 110k put and 120k call strikes—levels that align closely with Bitcoin’s recent price range. This setup suggests that while traders are positioning for higher prices, they remain mindful of downside risk, using the 110k strike as a key hedge in the current environment.

Recent Activities

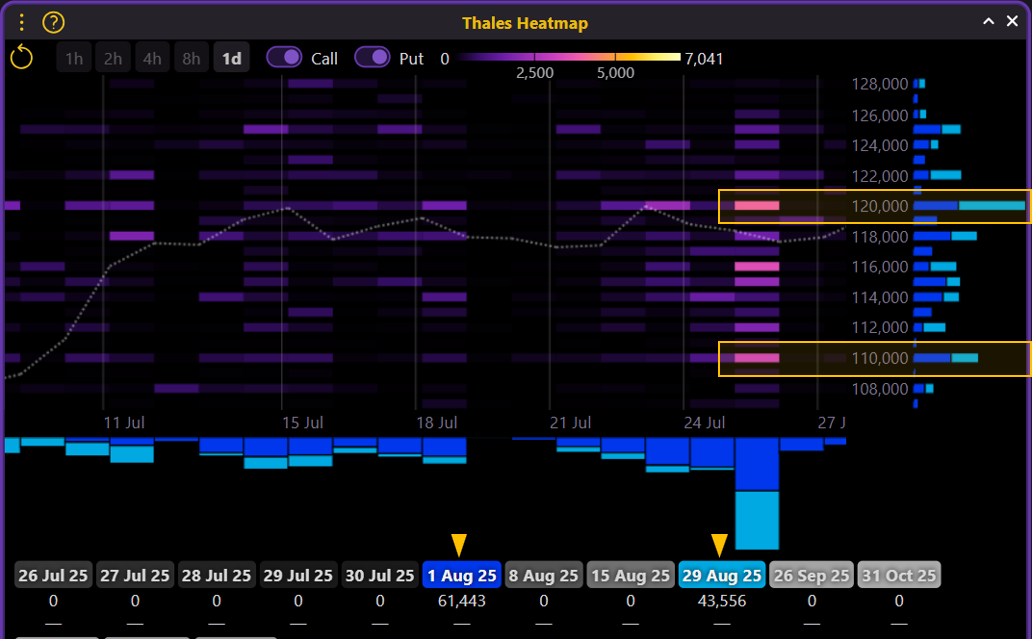

Thales Heatmap

Following the large expiry on July 25, we turn to the Thales Heatmap to assess where trader activity shifted. Focusing on the upcoming expiries of August 1 and August 29, we observe renewed concentration at the 110k and 120k strikes. These two levels stand out as the most actively traded during the day after expiry, reflecting both protective and speculative flows. Notably, the balance between call and put activity at these strikes appears relatively even, signaling a lack of clear directional conviction from market participants at that point. Traders seem to be recalibrating their positions rather than committing to a distinct bullish or bearish bias.

Market Screener

The Market Screener captures a rich snapshot of trader behavior from July 25, unfiltered except by entry date. The PnL curve (yellow) and delta curve (green) collectively point toward a structure dominated by a long put around the 110k strike and a bullish call spread—comprising long near-the-money calls and short far out-of-the-money calls. The sharply negative delta from the put signals strong demand for downside protection, while the gradual decline in delta on the call side implies call spread writing beyond certain levels. This pattern suggests that despite the broader bullish sentiment, traders were more focused on hedging downside risks in the short term.

Strategy Spotlight

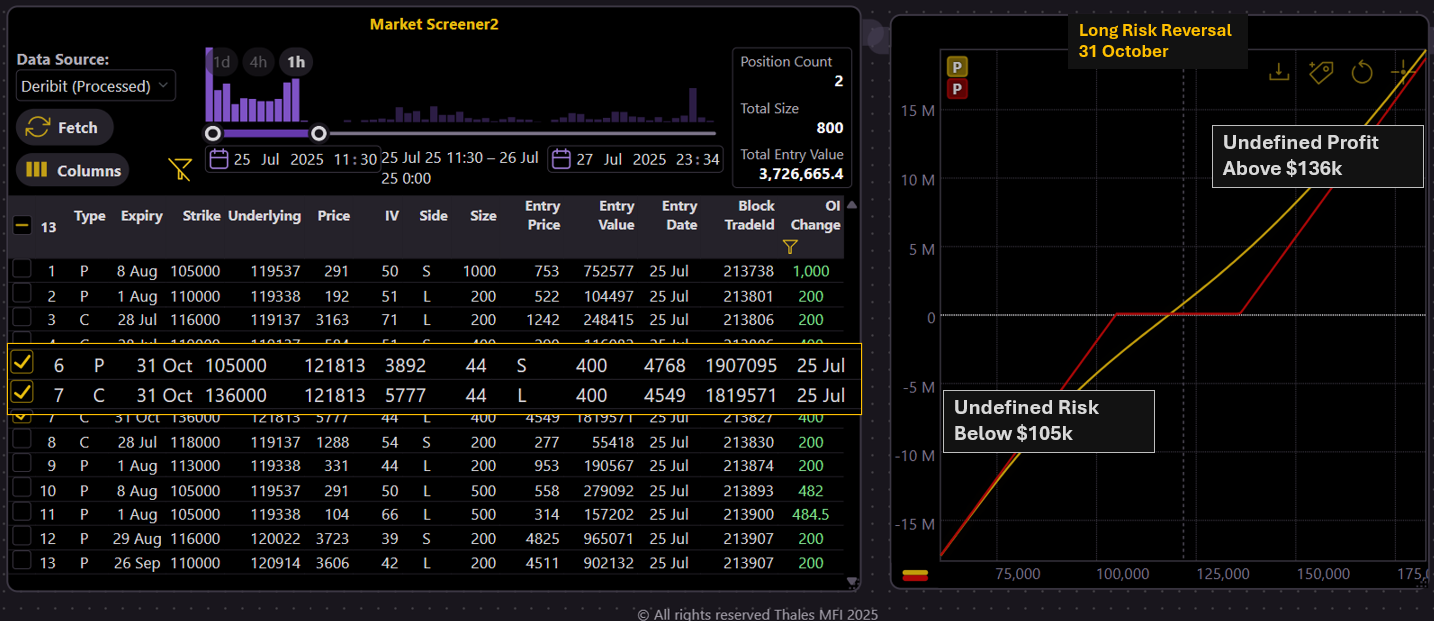

A Bullish Risk Reversal for October 31

The first multi-leg block trade captured by Thales Market Screener on July 25 is a bullish long risk reversal, involving a short put at the $105k strike and a long call at the $136k strike, both expiring on October 31. The trade size for each leg is 400 contracts, and both were executed at approximately the same premium, generating a small net credit. In effect, the trader received around $19 million from selling the put and spent about $18 million on the call—making this a cost-efficient way to express bullish conviction. The structure allows for unlimited upside above $136k, but comes with unlimited downside risk below $105k, implying the trader is confident that Bitcoin will stay above the $105k level and possibly break well beyond $136k by expiry.

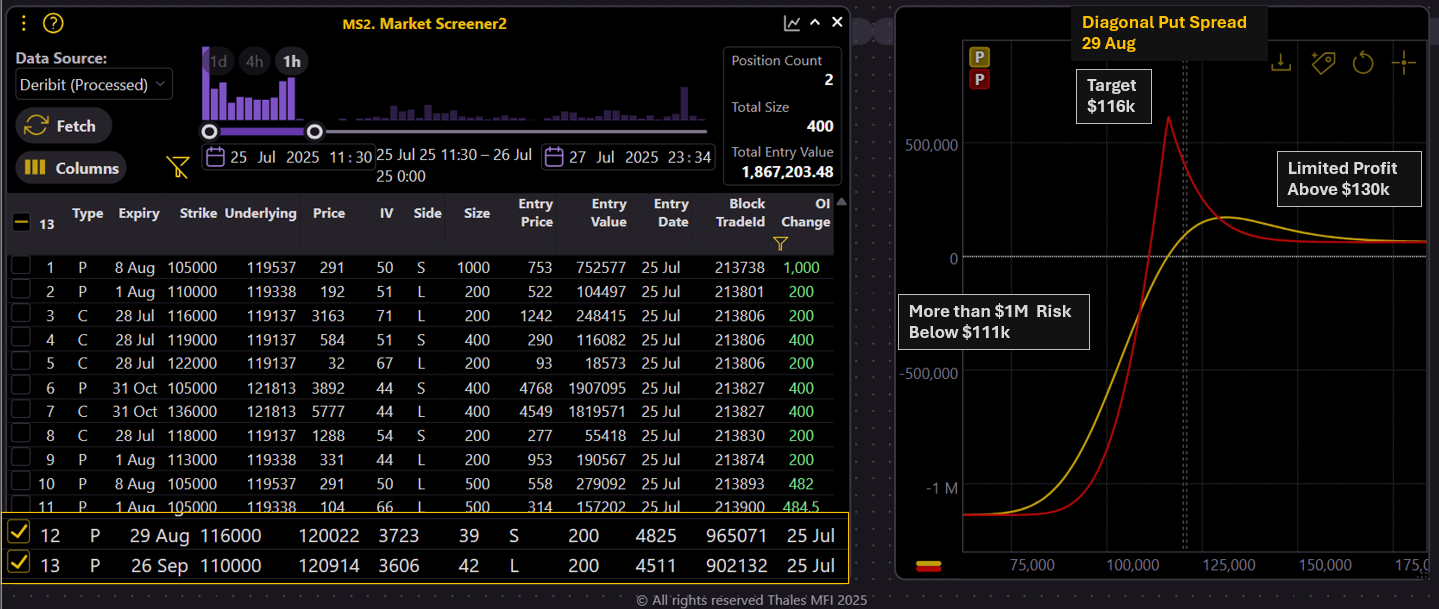

A Bullihs Diagonal Put Spread for 29 Aug.

The second multi-leg strategy spotted during the same July 25 window is a diagonal put spread, another structure with a neutral-to-bullish bias, targeting the August 29 expiry. The trade consists of buying 200 contracts of the $110k put expiring on September 26, and selling 200 contracts of the $116k put expiring on August 29, forming a calendarized vertical structure. The position will start gaining as long as Bitcoin stays above $111k by August 29, and reaches its maximum profit of roughly $600k if BTC closes exactly at $116k on that date. However, the downside is not negligible: if the price drops below $111k, the structure could incur losses exceeding $1 million, nearly double the max profit, due to the exposure on the longer-dated long put. Overall, the trade expresses a bullish directional view, with precise targeting and defined risk.

Bottom Line

The July 25 expiry delivered what it promised: a clean, max-pain finish that favored sellers and reset the board. Yet what followed was far more telling. Traders quickly rotated into new positions, with activity concentrating at the familiar 110k–120k range. The bias remains cautiously bullish—evident in the structure of upcoming open interest, falling implied volatility, and targeted strategies like risk reversals and diagonal spreads. Still, the appetite for downside hedging is far from gone, especially in the near term. As the August cycle takes shape, the market appears to be treading a fine line between riding the trend and respecting the risk.

Disclaimer

The content of this blog is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. The strategies and examples discussed are intended to illustrate concepts and do not represent recommendations. Trading in derivatives, including Bitcoin options, involves substantial risk and may not be suitable for all investors. Always conduct your own research and consult with a qualified financial advisor before making any trading decisions.